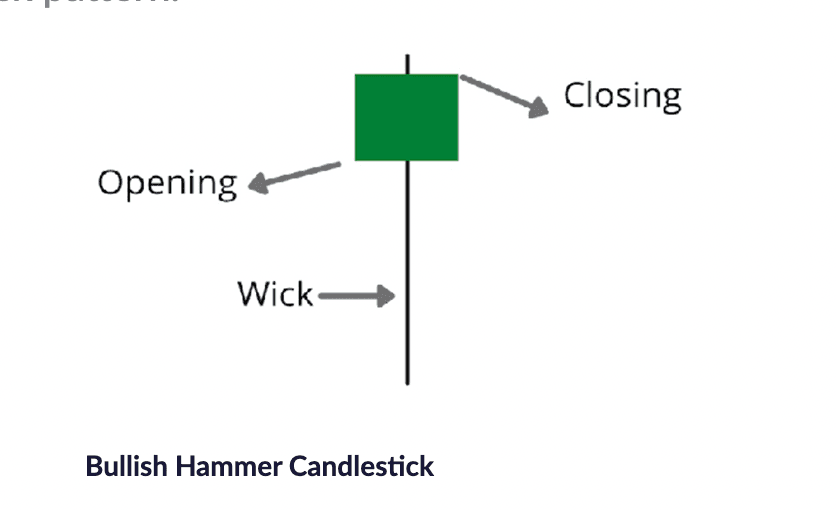

Hammer-

A hammer is a price pattern in candlestick charting that occurs

when a security trades significantly lower than its opening,

but rallies within the period to close near the opening price.

This pattern forms a hammer-shaped candlestick. This Candlestick pattern

is best when used with a support level. The price action shows that buyers

stepped in and took control.

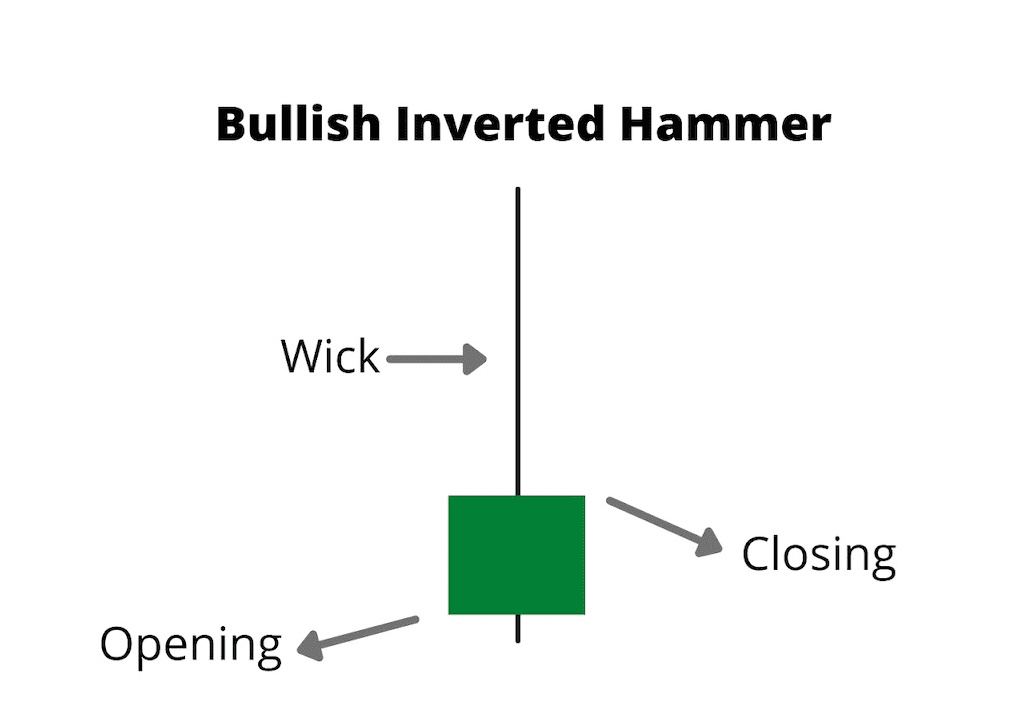

Inverted Hammer-

The Inverted Hammer candlestick formation occurs mainly at the bottom of a

downtrends and can act as a warning of a potential bullish reversal pattern.

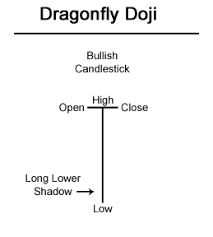

Dragonfly doji

A Dragonfly Doji is a type of single Japanese candlestick pattern

formed when the high, open, and close prices are the same.

It signals a potential reversal. The candle ends up with a tall lower wick and no body.

It is usually seen at the bottom of a downtrend.

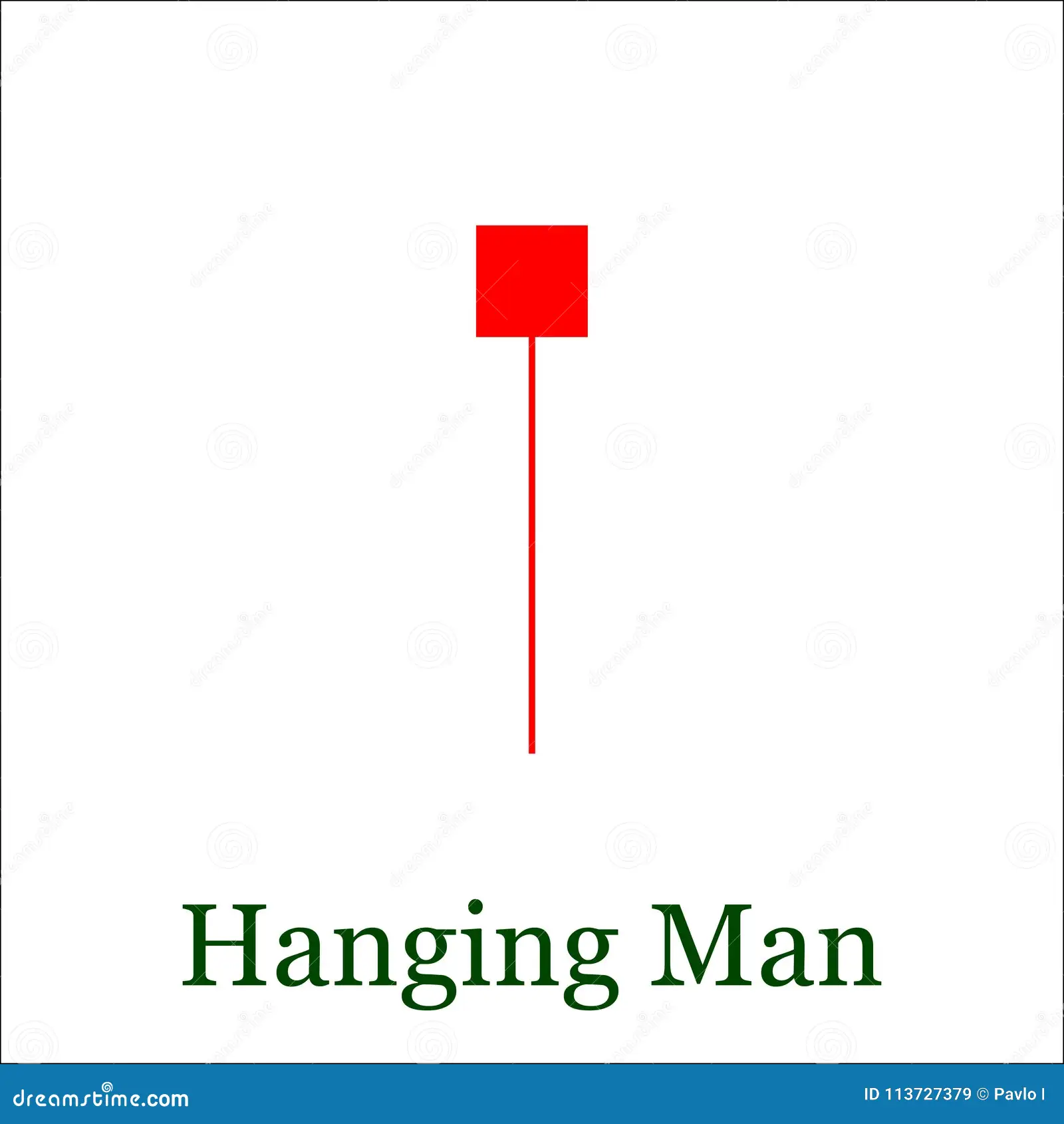

Hanging Man

A Hanging man candlestick occurs during a uptrend and warns that

prices may start to reverse. The candle is composed of a small real

body, a long lower shadow, and little or no upper wick.

Shooting Star

A shooting star candlestick can be recognised as a small bodied candlestick

with a long wick on the top and little to no wick at the bottom. This pattern

happens at resistance levels to give traders clue a reversal may happen.

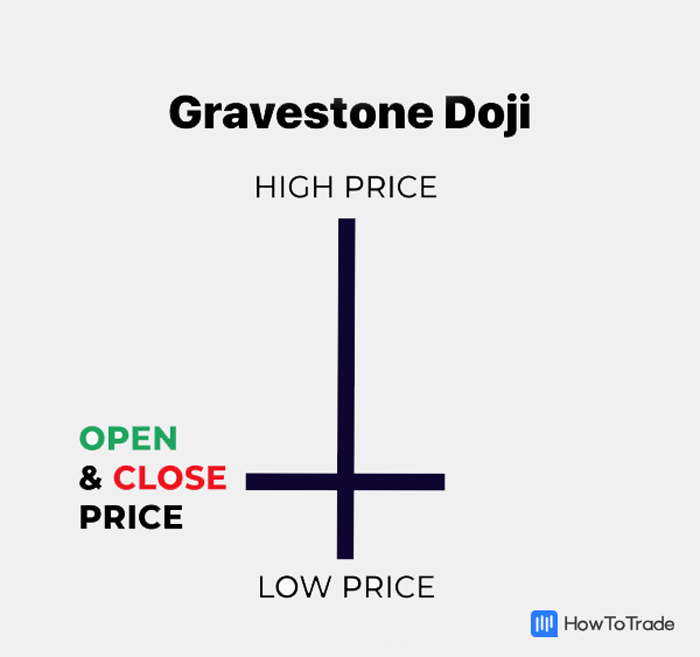

Gravestone Doji

A gravestone doji is formed when when the open,low,

and closing prices are all near each other with a long

upper wick.